Cairo: Egypt is ‘nearing the final stages’ of its talks with the International Monetary Fund (IMF) for a three-year loan programme, the government said, as it looks to repair an economy damaged by years of political upheaval.

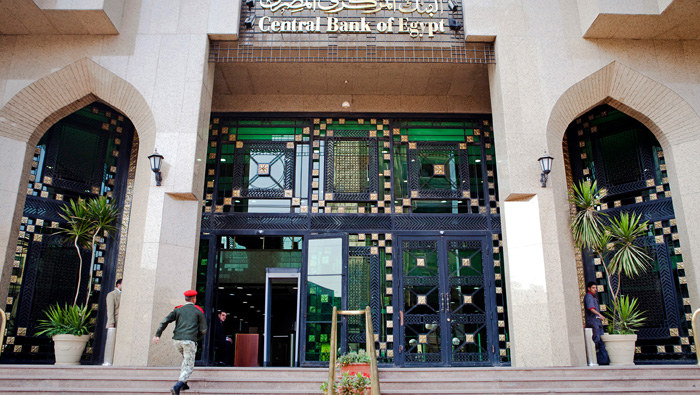

The central bank governor and finance minister will finalise negotiations with an IMF delegation due to arrive in Cairo within days, the cabinet said on Tuesday. Authorities are targeting $7 billion annually over three years to finance the programme, it said.

It plans to secure $12 billion from the IMF, Deputy Finance Minister Ahmed Kouchouk said. The rest would come from bilateral accords and international institutions, he added, including $3 billion and $1.5 billion from the World Bank and African Development Bank, respectively.

"This is very positive news. An agreement with the IMF would restore much of the lost confidence in egyptian policy makers,” said Hany Genena, head of research at Cairo-based Beltone Financial, an investment bank. "The IMF’s stamp of approval would attract billions of dollars in bilateral support and in private investments.”

Foreign reserves

Egypt is scrambling to increase its foreign-currency resources to ease a shortage that has stifled economic activity and fueled speculation of another imminent devaluation, or even flotation, of the pound. The dollar changed hands at 12.99 pounds on the black market on Tuesday, a 46 per cent premium over the official rate of 8.8, according to a survey.

The IMF visit will start on July 30, and is expected to last about two weeks, Masood Ahmed, director of the Middle East and Central Asia Department at the IMF, said in an e-mailed statement.

Foreign reserves plummeted as investors and tourists shunned the country following the 2011 uprising against then president Hosni Mubarak. They have stabilized since September, reaching about $17.5 billion last month.

Successor governments have unsuccessfully sought to secure IMF financing. Arab allies, including Saudi Arabia and the UAE, have stepped in to plug the country’s funding gap.

Apparent shift

William Jackson, senior emerging-markets economist at London-based Capital Economics, said that an "apparent shift towards more orthodox policy-making in the government and at the central bank” had increased chances for an accord with the IMF.

Since removing his Islamist predecessor in an army takeover and becoming president, Abdel-Fattah El-Sisi has pushed through controversial measures, including cuts in fuel and electricity subsidies, that previous governments avoided. Lawmakers are discussing the introduction of value-added taxation to increase revenues and cut the budget deficit, which reached 11.5 per cent of economic output in the last fiscal year.

El-Sisi’s rule also saw a crackdown on the Islamists he ousted from power, along with an increase in militant violence in Sinai and attacks in the capital.

At the central bank, Governor Tarek Amer said this month that defending the pound had been a "grave mistake,” signaling a preference for a weaker currency. In March, the bank devalued the pound by the most in more than a decade and vowed to implement a more flexible exchange rate, a promise that is yet to materialise.

"We expected an imminent devaluation, as soon as the value-added tax is done,” said Reham El-Desoki, senior economist at Dubai-based investment bank Arqaam Capital. The announcement on an IMF accord "will narrow the gap between the official and parallel rates significantly over the coming days.”