Muscat: The Omani stock market had a nearly flat performance during the week with the major index closing down by 0.07 percent and hovering close to the 48,00 level, which presents the next challenge for the recent rebound, according to an analyst.

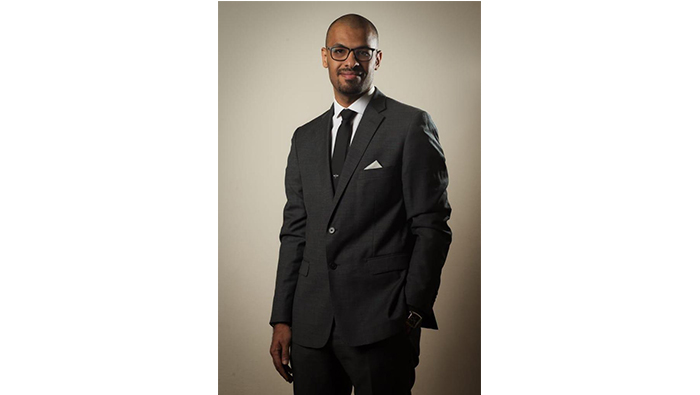

“This movement reflects a quieter market environment with a drop in the number and value of shares traded as there were no significant news or events to influence the market's direction,” said Ahmed Negm Head of Market Research MENA at XS.com.

“The market could remain exposed to the volatility in oil markets as well as downside risks as geopolitical conditions continue to change,” he further added.

In terms of sector performance, both the services and financial sectors recorded losses, while the industrial sector posted gains.

The services sector was the weakest performer this week, declining by 1.21 percent. OQ Gas Networks fell by 1.39 percent, while telecommunications companies Oman Telecom and Ooredoo fell by 0.38 percent and 1.01 percent, respectively.

The financial sector also experienced a downturn, decreasing by 0.18 percent. Sohar International Bank dropped by 2.19 percent. The stock was the second most traded during the week and declined as traders moved to profit-taking following the last few weeks’ gains, which were driven by a significant increase in first-quarter profits. Additionally, Global Financial Investment reported losses of 4.11 percent, and Oman Emirates Holding also recorded losses of 2.33 percent.

Conversely, the industrial sector showed a positive performance, increasing by 0.90 percent. Galfar Engineering and Contracting led the sector's weekly performance with a 7.45 percent rise and was the most traded stock. The OMR521 million contract for the Oman-UAE Rail project that the company secured last month could continue to support its performance. Moreover, Oman Cables Industry enjoyed an increase of 4.31 percent, continuing its upward trend of more than three years.

The stock market could benefit from expectations of a stronger tourism sector in Oman, said Ahmed Negm.

“The country’s travel and tourism sector could see solid growth and could make significant contributions to gross domestic product (GDP) and job creation,” he further added.

“This surge could positively impact stocks in the hospitality, transportation, and retail sectors, while also bolstering the broader economy through increased international spending,” said Ahmed Negm.